Score Investment Memo

Subnet 44 on Bittensor

August 2025

Snapshot

Description: Score is building the core infrastructure for next-generation sports intelligence: an AI-powered annotation engine that transforms raw game footage into structured, actionable data. Initially focused on soccer, Score’s platform significantly reduces costs compared to manual video analysis, enabling teams at all levels to access detailed analytics.

Subnet Output: The subnet miners output JSON files that contain annotated video data of soccer matches. Miners detect objects such as players on each team, referees, and the soccer ball. At the moment, miners are processing full-length (90 min) soccer matches in less than 2 mins.

Market & Token Upside: Score's immediate focus is the sports analytics market for mid and lower-tier teams. Our bottom-up analysis indicates this segment represents approximately a $1.8 billion market opportunity. We believe Score is well-positioned to capture around 18% of this market. If achieved, this could imply a 51x higher valuation for the subnet’s token.

Team: The team is one of the more impressive teams within the subnet ecosystem. Score has 10-12 full-time employees who bring decades of product experience, strong experience scaling consumer and AI-based projects, and connections to various hedge funds and professional sports teams.

Core Team:

Maxime Nassim Sebti (CEO) – AI entrepreneur and former founder CrunchDAO

Tim Kalic (CTO) – Computer vision and systems lead

Peter Cotton (CSO - Science) - JP Morgan Quant, Mathematics PhD at Stanford

Nigel Grant (CSO - Strategy) – Former Microsoft product strategist

Brian McDermott (Head of Football) - Ex-Arsenal player and coach

Advisors:

Lee Mosbacker - Sports-focused hedge fund manager

Justin Dellario – Previously VP of Esports at Twitch, Exec at Entain

Investment Rationale

We view Score as a venture-style investment. It’s a seed-stage subnet (in terms of maturity) operating in a massive, underpenetrated market with billion-dollar token valuation potential. At this stage, our thesis is primarily driven by team quality and market size. While the incentive mechanism (IM) design is important, we expect it to evolve. Our ongoing conversations with Tensora—Score’s lead miner and a key contributor to the IM—give us confidence that the current system is sound and that the team has access to the right resources to iterate as the network grows.

What gives us conviction is the caliber of the team and the maturity with which they operate. From professional communication to consistent execution and deep ties across both sports and AI, Score is outpacing other subnets at this stage.

As of July 31st, the subnet token trades at 0.0269 TAO, implying a fully diluted valuation (FDV) of $211M, with only 1.9M tokens (9% of the total supply) in circulation. There’s been growing recognition across the market that traditional FDV metrics fall short and new market standards are needed. We agree, and have developed a dedicated valuation framework tailored specifically to subnet tokens, which operate with transparent emissions, no insider allocations, and high staking yields from day one.

Using this framework, we adjust FDV based on our expected holding period and the impact of staking. Over a 24-month horizon—when we project 11.1M (53% of the total supply) tokens will be in circulation—we apply a 53% discount to the current FDV. We also factor in staking yield which effectively reduces our TAO-denominated cost basis by 43% over the same period. Combined, these adjustments imply a 70% discount to today’s headline FDV—bringing our “Adjusted FDV” to just $63M.

While we expect to hold longer than two years, we use a 24-month horizon for modeling purposes, as assumptions tend to break down beyond that point. We believe this timeframe balances realism and rigor, without overstating potential upside.

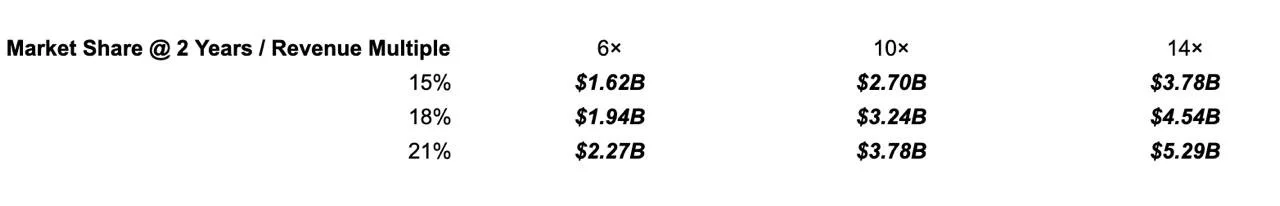

We calculate Score’s immediate market opportunity at $1.8B (see 'Market' section), grounded in a concrete, serviceable segment rather than a broad or aspirational TAM. Based on our research and conversations with the team, we believe they can realistically capture 25-35% of this market over a four-year period. For valuation purposes, however, we focus on a two-year horizon. On that basis, we model 60% progress toward the long-term target, resulting in 15-21% market share.

Looking at comps—and given Score’s earlier stage and crypto’s tendency to trade at premium multiples—we apply a 6–14x revenue multiple. For context, Sportsradar, a relevant public comp, IPO’d at 12.1x and currently trades at 6.7x.

Using the midpoint of these ranges, we arrive at a $3.24B implied valuation. That represents a 51x upside from Score’s current Adjusted FDV, making this is an extremely attractive entry point.

Overview

Soccer teams rely heavily on game footage analysis for identifying opponent matchups, recruiting players, and conducting performance reviews where coaches break down specific plays with players. Extracting deeper insights from this footage requires annotation, the process of converting raw video into structured, machine-readable data. Historically, this has been the core constraint in sports analytics because of how slow, expensive, and largely manual it is.

Game State Recognition on soccer footage + 2D Schema of the Game State Recognition

Companies like Opta and Hudl (Wyscout) have scaled by hiring large analyst teams to label events across matches. Hudl currently processes over 250 football games per week, while Opta provides coverage across 30+ sports in more than 70 countries. Despite their scale, both remain heavily reliant on human labor. Other companies, such as Catapult Pro Video, have turned to advanced hardware solutions like GPS vests, which require each player to wear specialized equipment. Firms like iSportsAnalysis and Hawk-Eye offer software tools, but the underlying pattern remains the same—these systems are expensive, semi-manual, and have yet to fully capitalize on modern computer vision tech.

Score introduces a new model: an incentivized computer vision engine built for sports analysis on Bittensor Subnet 44. It functions as the first open marketplace for soccer match data, where miners compete to produce high-quality annotations and are rewarded based on performance. This creates two parallel races: one to drive down annotation costs, and another to push up performance and accuracy—fueled by some of the sharpest machine learning minds in the world.

By designing a system that aligns incentives and embraces open competition, Score dramatically lowers the cost of performance data and makes elite-level analytics accessible to teams that were previously priced out. What once required a team of analysts watching matches in real time is now being replicated in under two minutes on the subnet.

The process begins with the subnet owner, Score Technologies, uploading full match footage to the network, which is divided into 30-second segments. Each segment is sent to miners, who run object detection on every frame—identifying players (including team affiliation), tracking the ball, spotting referees and goalkeepers, and locating key pitch landmarks like corners, penalty areas, and the center circle. These detections are translated into precise (x, y) coordinates and compiled into structured JSON files containing complete frame-by-frame annotations. Once submitted, validators review the results using models like CLIP to confirm object identity, perform geometric checks to verify positioning, and run targeted quality audits on selected frames.

The data produced by the network can be used not only by Score Technologies, but by any team or business building new products or enhancing existing ones.

Market

Score can be applied across three primary markets: sports data and analytics, fantasy sports, and sports betting. While the fantasy and betting markets are large and growing, our focus is on the sports analytics segment, where data availability is higher and near-term adoption is more realistic.

When Liverpool introduced dedicated analytics in 2012 with just one Director of Research and a $400K budget, it sparked a data revolution across soccer. By 2024, top Premier League clubs averaged 14 analytics staff members. This created a significant competitive edge, with data-driven teams gaining clear advantages in player recruitment and preparation, which has made analytics an essential operational tool across the sport.

However, professional-grade analytics remain expensive and complex, leaving most mid and lower-tier teams relying on basic software tools or manual analysis. This creates a massive opportunity for automated analytics solutions that can deliver professional-grade insights at accessible price points for teams that cannot afford to hire full analytics departments.

For this market analysis, we focused on the three most popular sports that would benefit from Score's services: soccer, football, and basketball. These sports represent the largest addressable markets with established demand for analytics solutions across collegiate and amateur levels.

For Soccer, there are an estimated 5,000 collegiate-level/semi-pro teams across Europe and the Americas that currently rely on expensive software, manual analysis, or coaches for player performance and recruiting insights. This estimate includes men's and women's leagues spanning Division 1, Division 2, Division 3, NAIA, and NJCAA, as well as semi-pro and collegiate leagues in Europe, Canada, and Mexico.

D1 and semi-pro teams (~3,800 teams) present the largest market opportunity at $190M annually, with an average spend of $50,000 per team, while lower-tier teams (~1,200 teams) offer an additional $6M market at $5,000 per team. Score's immediate impact opportunity represents approximately $196M annually across these mid and lower-tier soccer teams.

The U.S. football landscape comprises 772 universities programs spanning FBS, FCS, Division I-III, NAIA, and independent institutions, alongside 15,810 high school football. University programs represent the collegiate tier at $386M annually, averaging $500,000 per team. High school programs contribute $79M market opportunity at $5,000 annually. Score's immediate impact opportunity represents $465M annually across these football programs.

For basketball there are approximately 1,400 colleges and universities plus 17,000 high school teams in the US, alongside an estimated 1,500 semi-professional teams and 8,000 lower league clubs in Europe. We assume universities and semi-pro programs spend ~50% of their football counterparts, implying a $250,000 average budget per team which then generates $725M annually. High school and lower league programs represent $125M market opportunity at $5,000 per team. Score's immediate impact opportunity represents $850M annually across these basketball programs in the US and Europe.

The hyper-analytification of sports is unfolding across nearly every major sport, not just soccer. While Score starts with soccer, the subnet can be broadened to apply to football, basketball, baseball, and other sports. This positions Score to move well beyond its initial beachhead and capture significant share in the fast-growing global sports analytics market. While fast-growing, these adjacent markets are still nascent. We estimate these emerging markets represent 20% of the combined market of soccer, football, and basketball, bringing the total market opportunity size to $1.8B.

While Score's immediate focus targets mid and lower-tier teams where data availability is scarce, they are well-positioned to expand into major professional leagues like the NFL, NHL, and NBA. These leagues aren’t included in our current market sizing, as we’ve intentionally limited our estimate to what’s directly within reach today. That said, it would be conservative to apply a 2x multiple to account for professional leagues, putting the total market opportunity closer to $3.6B.

Key Reasons for Investing

Experienced and well-connected team: Breaking into these markets and gaining trust from these clubs requires relationships/networks with teams and deep knowledge of the game (i.e., have to be part of the “in-crowd” of soccer). Max has assembled one of the strongest and most professional teams we’ve seen in the subnet ecosystem. Key team additions include Brian McDermott (ex-Arsenal player-coach) as Head of Football and Justin Dellario (former VP of Esports at Twitch) as an advisor, giving the team both technical credibility and insider access. On the data side, they’re bringing on Peter Cotton, a former quant at JP Morgan, while sports-focused hedge fund manager Lee Mosbacker serves as an advisor. The team now includes 10–12 full-time employees with decades of product experience and critical connections to professional sports organizations.

Well-defined revenue streams and product value proposition: Lower level clubs (e.g., amateur/regional clubs and youth through collegiate levels) have smaller budgets but still want the edge that baseline data analytics can generate for coaches and players. These clubs are ideal, immediate customers for Score’s annotated game footage product, which delivers professional-grade data at a fraction of the cost. Additionally, Score’s partnership with a sports-betting hedge fund indicates there’s demand from these markets, where they’ll purchase and combine Score’s annotated game footage with proprietary, advanced analytics.

Specifically within Bittensor subnet markets, we’ve observed that subnets with strong revenue potential or existing revenue-generating products outperform on a relative basis. Four of the top five subnets by market capitalization are product-focused with a clear line of sight on revenue generation, compared to those with a focus on cracking pure, deeply technical research problems. We believe subnet teams that can leverage their revenue streams to offset structural sell pressure on their token will lead to continued relative outperformance. This is specifically important in the current dTAO market environment.

Tangible use case: Score stands out for its clarity and relatability. Unlike many subnets that are highly technical and abstract, Score’s value proposition is easy to grasp and resonates widely. It doesn’t require deep domain expertise to understand, and it consistently sparks interest in conversations at conferences and events. People immediately connect with it, in large part because of the universal appeal of sports and the growing role of data in how fans and teams engage with the game. For this reason alone, we believe Score is well-positioned to attract meaningful capital flows from retail participants.

Key Risks

Miner + holder centralization: Our analysis of the miner set, supported by direct conversations with Tensora, confirms that they are both the leading miner and a significant holder of SN44. At present, they account for approximately 75% of miner emissions—a level of concentration that introduces two key risks: economic, in the form of potential sell pressure from a single large holder; and technical, as a disproportionate share of service provision is reliant on one miner’s infrastructure and availability. While Tensora has selectively sold at specific price points to manage exposure, we’ve had ongoing dialogue with their team. Based on these discussions, we believe their incentives are aligned with the long-term success of the subnet. Tensora has made significant investments to remain competitive within Score and are likely to benefit more from continued value creation than short-term extraction.

Token-Demand Linkage: There’s currently no structural demand for the token, but the team plans to change this by implementing a buy-and-burn mechanism using revenues eventually generated by Score Technologies. This is an essential step toward making the economic model sustainable, as Score Technologies will need to drive value into the subnet to fuel and grow their broader business. We’re confident in the team’s ability to execute on this and are prepared to support them directly, drawing on our experience with value capture mechanisms for crypto utility networks.

Product challenges: Score’s reliance on third-party game footage limits its reach to teams that already have the ability to film matches, creating a constraint compared to competitors. Some companies like Hawk-Eye offer bundled solutions, coupling their own camera hardware with data analytics services. Additionally, emerging wearable technologies, like GPS-enabled vests, are beginning to provide deeper, sensor-based analytics that could surpass the insights possible from video alone. While these do present constraints on Score in the long run, they present little-to-no impact on Score’s initial product offering to mid and lower-tier teams. GPS-enabled vests and similar wearable tech are generally high-cost and beyond the budget limitations of effectively all the lower level clubs Score is targeting. Over time, Score’s annotated video data could serve as a valuable input for sensor-based or hybrid analytics platforms, positioning it as a data provider rather than just a competitor.

Competitive computer-vision subnet landscape: There are now four Bittensor subnets that require computer-vision technology. Each is starting out with their own narrow focus (e.g., deepfake detection, street view object detection, etc), but will likely expand their scope over time to capture more market opportunities, meaning there’s significant competition. However, Score’s immediate focus on the underserved soccer data analytics market provides a clear go-to-market strategy as well as a large market to continue breaking into for the foreseeable future.

This content is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security. Unsupervised Capital holds a position in TAO and may hold positions in the subnet tokens or other digital assets discussed herein and may buy, sell, or change positions at any time. Past performance is not indicative of future results. Digital assets involve substantial risk, including potential total loss of capital. Consult your own advisers regarding any investment decisions.

Investment in digital assets and blockchain technology involves substantial risk and may result in partial or total loss of investment. Digital assets are subject to extreme price volatility, regulatory uncertainty, and market manipulation. Past performance is not indicative of future results. This memorandum is for informational purposes only and does not constitute investment advice, an offer to buy or sell securities, or a solicitation of any offer to buy or sell securities. Recipients should consult their own advisors before making investment decisions. This memorandum contains projections and estimates based on current expectations. Actual results may differ materially from those projected. All forward-looking statements are subject to risks and uncertainties. Unsupervised Capital Management, LLC makes no representations regarding the accuracy or completeness of information herein. Third-party information has not been independently verified. To the maximum extent permitted by law, Unsupervised Capital Management, LLC shall not be liable for any damages arising from this memorandum. By reviewing this memorandum, you acknowledge these disclosures. This information is subject to change without notice.